Managing your finances effectively is crucial for achieving financial stability and building wealth. Whether you want to save for a big purchase, pay off debt, or plan for retirement, implementing strategies to boost your finances can help you reach your goals. In this article, we will explore several key areas to focus on in order to improve your financial situation.

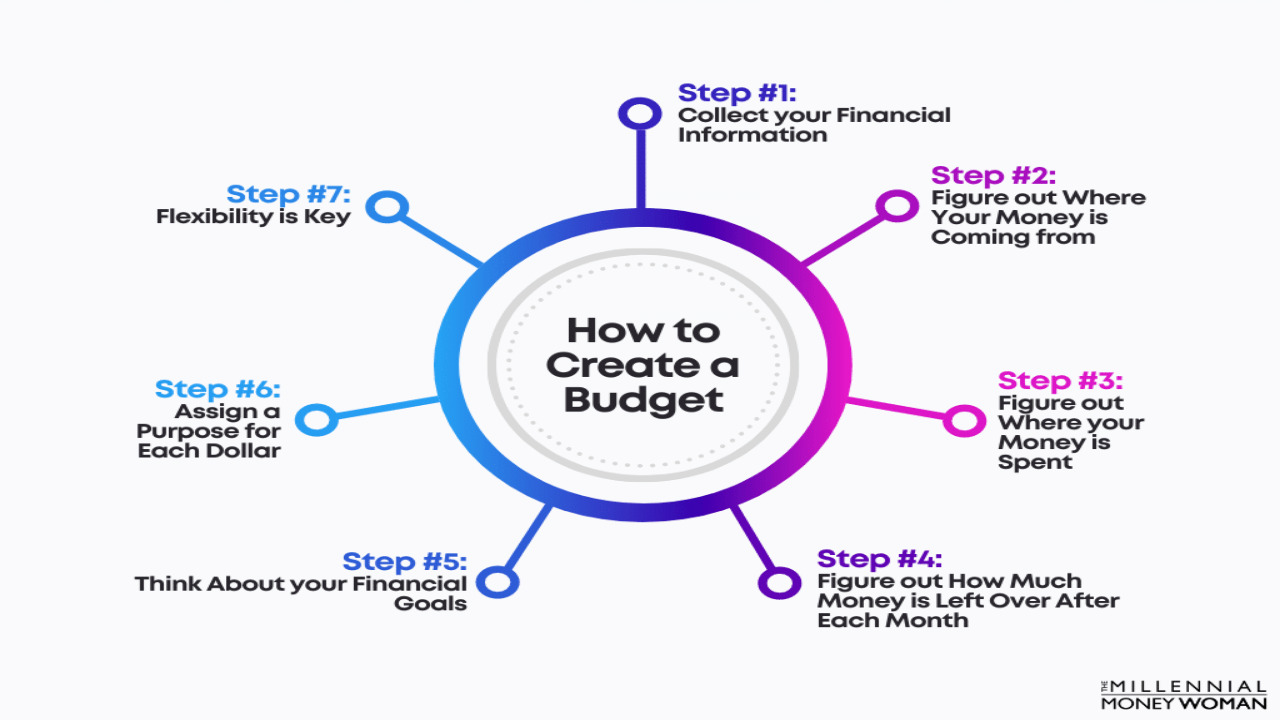

Create a Budget

Creating a budget is the foundation of financial management. Start by assessing your income and expenses. Categorize your expenses into essential (e.g., rent, utilities, groceries) and discretionary (e.g., dining out, entertainment). Identify areas where you can reduce spending and allocate more towards savings or debt repayment. Use budgeting apps or spreadsheets to track your expenses and stay on top of your financial goals with ready pay stub templates.

Reduce Debt

High-interest debt can be a significant drain on your finances. Prioritize paying off debts with the highest interest rates first, such as credit card debt. Consider consolidating debts or negotiating with creditors for lower interest rates. Make consistent, timely payments to reduce your debt burden over time. Additionally, avoid taking on new debt unless necessary.

Increase Your Income

Finding ways to increase your income can significantly boost your financial situation. Look for opportunities to earn extra money, such as taking on a side gig, freelancing, or monetizing a hobby. If applicable, negotiate a raise or explore higher-paying job opportunities. Use any additional income to accelerate debt repayment or contribute to your savings and investments.

Build an Emergency Fund

An emergency fund is a crucial component of financial stability. Aim to save at least three to six months’ worth of living expenses in a separate, easily accessible account. This fund provides a safety net during unexpected events, such as job loss or medical emergencies, and helps you avoid dipping into debt. Set up automatic contributions to your emergency fund to make consistent progress.

Invest for the Future

Investing allows you to grow your wealth over time. Consider opening a retirement account, such as an IRA or 401(k), and contribute regularly. Take advantage of employer matching contributions if available. Research different investment options, such as stocks, bonds, or real estate, and diversify your portfolio to mitigate risk. Consult with a financial advisor if needed.

Save on Expenses

Cutting back on expenses is an effective way to boost your finances. Look for opportunities to save on recurring expenses, such as negotiating lower insurance premiums, canceling unused subscriptions, or shopping for better deals on utilities. Consider making small lifestyle changes, like cooking at home more often, using public transportation, or shopping with a grocery list to avoid impulse purchases.

Educate Yourself

Financial literacy plays a crucial role in making informed decisions about your money. Take the time to educate yourself about personal finance topics such as budgeting, investing, and debt management. Read books, listen to podcasts, and follow reputable financial websites to expand your knowledge. Join local workshops or online courses to enhance your financial skills further.

Review and Adjust Regularly

Financial management is an ongoing process. Regularly review your budget, investments, and goals to ensure you’re on track. Make adjustments as necessary to accommodate changes in income, expenses, or priorities. Set short-term and long-term goals and celebrate milestones along the way to stay motivated.

In conclusion, boosting your finances requires discipline, planning, and continuous effort. By creating a budget, reducing debt, increasing your income, building an emergency fund, investing for the future, saving on expenses, educating yourself, and regularly reviewing and adjusting your financial strategy, you can significantly improve your financial situation and work towards achieving your financial goals. Remember, small steps taken consistently can lead to significant financial progress over time.